Discounted Cash Flow Training: Step-by-Step Guide

Discounted cash flow training is one of the most important skills anyone can learn in finance, investing, or business valuation. Whether you want to become a financial analyst, make better stock investment decisions, or understand how companies calculate their true value, discounted cash flow (DCF) analysis plays a key role.

Many people hear the term “DCF valuation” and feel scared because it sounds complex and technical. In reality, discounted cash flow is based on a simple idea: money today is worth more than money in the future. Once you understand this idea, the rest of DCF becomes much easier.

In this detailed guide, you will learn what discounted cash flow training is, why it matters, what you learn in a DCF course, and how you can master DCF step by step. This article is written in simple words, so even beginners can understand it without stress.

What Is Discounted Cash Flow (DCF)?

Discounted cash flow, also known as DCF, is a method used to find the true or intrinsic value of a business, stock, or investment. It works by estimating how much cash a company will generate in the future and then converting that future cash into today’s value.

The core idea behind DCF is very simple.

Imagine someone offers you two choices:

- Receive $100 today

- Receive $100 after five years

Most people will choose $100 today. Why? Because money today can be invested, saved, or used immediately. Inflation and risk also reduce the value of future money. This concept is called the time value of money, and it is the foundation of discounted cash flow analysis.

DCF answers one important question:

“What is this investment really worth today based on the cash it will generate in the future?”

Discounted cash flow training teaches you how to:

- Forecast future cash flows

- Apply a discount rate

- Calculate present value

- Estimate the intrinsic value of a company

Why Discounted Cash Flow Training Is Important

Discounted cash flow training is important because DCF is one of the most reliable valuation methods used by professionals around the world. Investment banks, private equity firms, equity research analysts, and corporate finance teams rely heavily on DCF models.

Here are some key reasons why learning DCF is valuable:

1. It Helps You Find True Value

Market prices change daily, but DCF focuses on fundamentals. DCF training teaches you how to look beyond stock prices and find real value.

2. It Improves Investment Decisions

Investors use DCF to decide whether a stock is undervalued or overvalued. This reduces emotional and speculative decisions.

3. It Is Widely Used in Finance Careers

DCF skills are essential for roles in:

- Investment banking

- Equity research

- Corporate finance

- Financial planning and analysis

4. It Builds Strong Financial Thinking

DCF training improves your understanding of cash flows, risk, growth, and business performance.

Because of these benefits, discounted cash flow training has become a must-have skill for finance students and professionals.

Who Should Take Discounted Cash Flow Training?

Discounted cash flow training is not only for experts. Many different people can benefit from learning DCF.

Finance and Accounting Students

Students who study finance, accounting, or economics can use DCF skills to stand out in interviews and exams.

Business and MBA Students

DCF helps business students understand valuation, mergers, acquisitions, and strategic decision-making.

Stock Market Investors

Investors use DCF to estimate the fair value of stocks and avoid overpaying.

Financial Analysts

Analysts rely on DCF models to create valuation reports and investment recommendations.

Entrepreneurs and Business Owners

Business owners use DCF to value their companies and plan long-term growth.

If you want to understand how money works in real business situations, discounted cash flow training is worth learning.

What You Learn in Discounted Cash Flow Training

A good discounted cash flow training program teaches both theory and practical skills. Below are the main topics you usually learn in a DCF course.

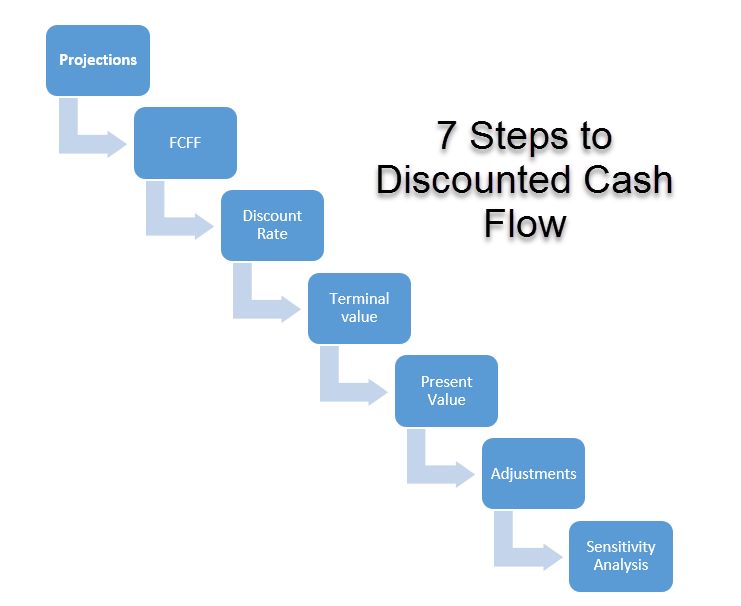

Understanding Cash Flows

Cash flow is the most important part of DCF analysis. DCF training explains:

- What does cash flow means

- Why profit is not the same as cash flow

- How businesses generate cash

You learn about free cash flow, which shows how much cash a company can use after covering expenses and investments.

Forecasting Future Cash Flows

DCF training teaches you how to estimate future cash flows by:

- Analyzing revenue growth

- Estimating operating costs

- Considering capital expenditures

- Adjusting for taxes and working capital

Forecasting helps you build realistic assumptions instead of guessing numbers.

Understanding Discount Rate and Risk

The discount rate reflects risk and opportunity cost. In discounted cash flow training, you learn:

- Why risk matters in valuation

- How to calculate discount rates

- The concept of WACC (Weighted Average Cost of Capital)

This step helps you adjust future cash flows to today’s value.

Terminal Value Calculation

Most of a company’s value comes from the future beyond forecast years. DCF training explains:

- What does terminal value means

- How to calculate it using growth methods

- How long-term assumptions affect valuation

Building a DCF Model in Excel

Practical training includes:

- Creating cash flow forecasts

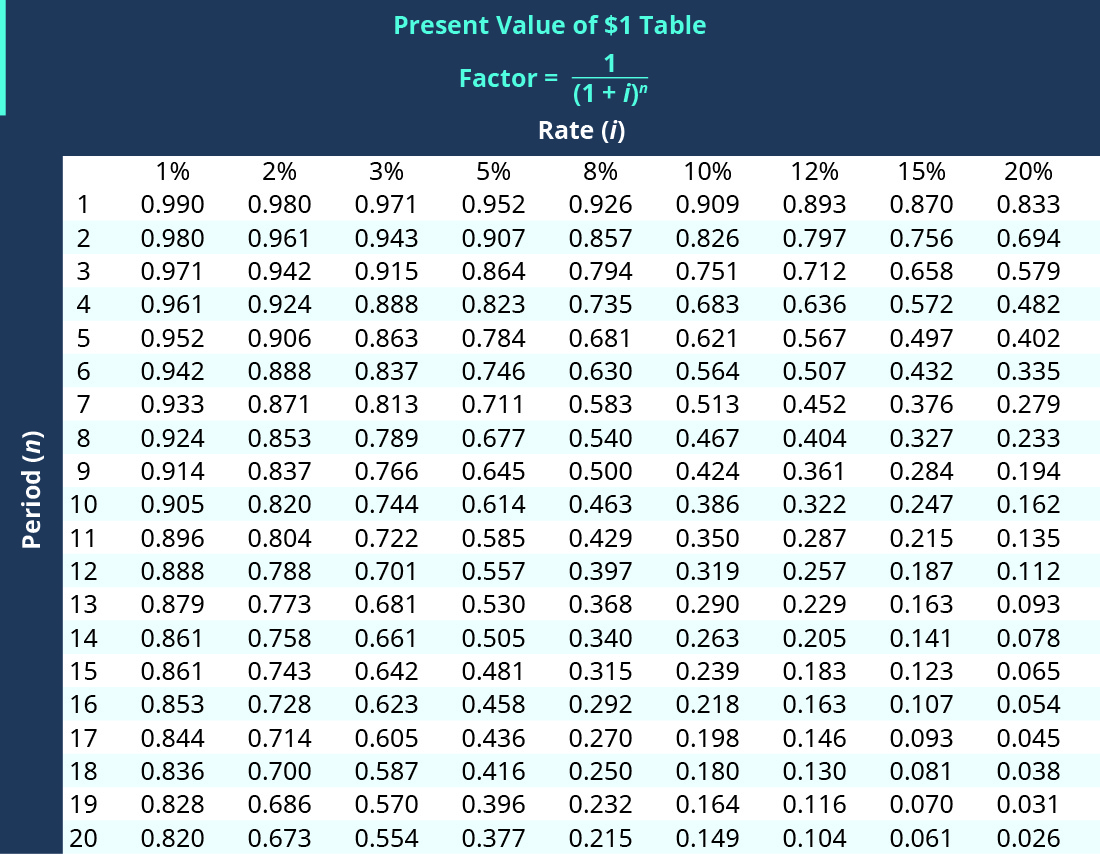

- Applying discount factors

- Calculating present values

- Running sensitivity analysis

Excel-based DCF models are widely used in professional finance jobs.

Step-by-Step Discounted Cash Flow Example

Let’s walk through a simple discounted cash flow example to make the concept clear.

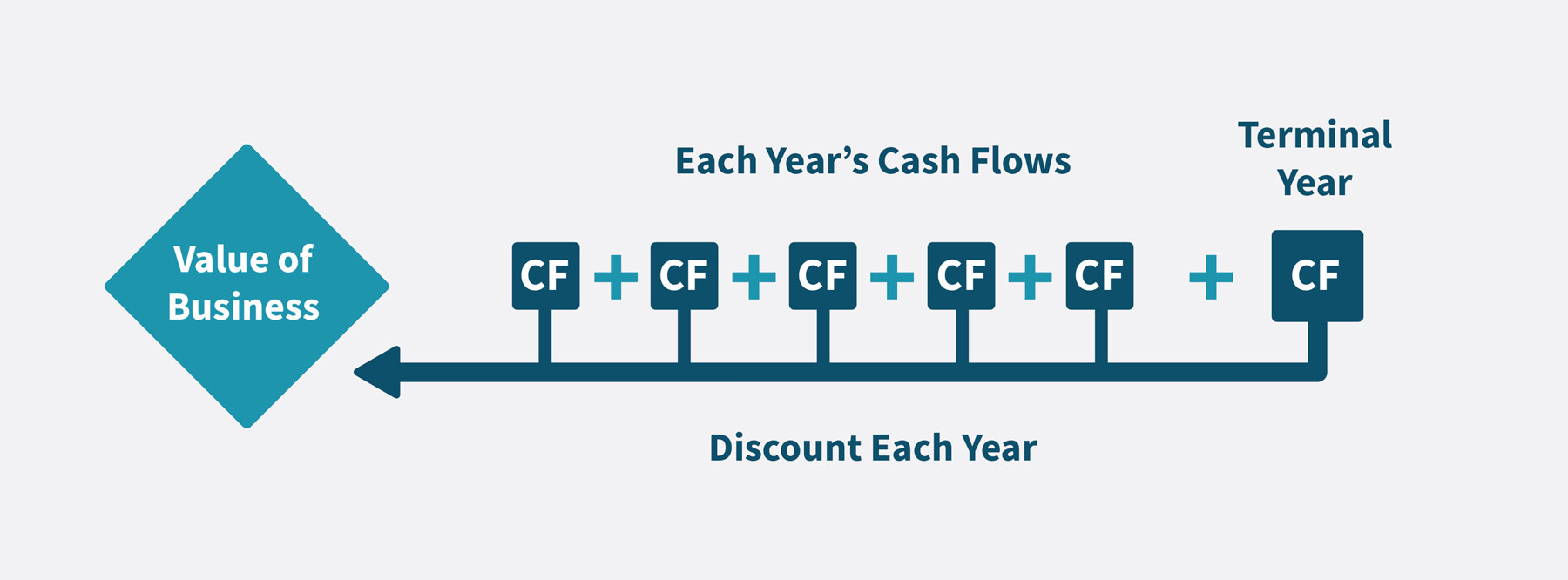

Step 1: Estimate Future Cash Flows

Assume a company generates $10 million in free cash flow this year. You expect it to grow by 5% annually for five years.

Step 2: Choose a Discount Rate

Assume the discount rate is 10%. This rate reflects risk and alternative investment opportunities.

Step 3: Discount Future Cash Flows

You calculate the present value of each year’s cash flow using the discount rate.

Step 4: Calculate Terminal Value

After year five, you assume stable growth and calculate the terminal value.

Step 5: Find Intrinsic Value

You add all discounted cash flows and terminal value to get the company’s intrinsic value.

This process may sound complex, but discounted cash flow training breaks it down into easy steps.

Free vs Paid Discounted Cash Flow Training

Many people ask whether free DCF resources are enough or if paid training is better.

Free Discounted Cash Flow Training

Free resources include:

- Blog posts

- YouTube videos

- Basic tutorials

These are useful for understanding basic concepts, but they often lack structure and depth.

Paid Discounted Cash Flow Training

Paid courses usually offer:

- Step-by-step lessons

- Real-world case studies

- Excel modeling practice

- Certificates

Paid training saves time and builds confidence, especially for career-focused learners.

If you want great skills and professional growth, paid discounted cash flow training is usually the better option.

How to Choose the Best Discounted Cash Flow Training

Not all DCF courses offer the same value. Use the checklist below to choose the right one.

Look for Practical Learning

The course should include real Excel models and exercises.

Check Instructor Experience

Instructors with finance industry experience explain concepts more clearly.

Review Course Structure

Good training starts with the basics and moves toward advanced topics.

Look for Reviews and Feedback

Student reviews help you judge course quality.

Certification and Career Value

Some courses offer certificates that help in job applications.

Choosing the right discounted cash flow training saves time and improves results.

Career Opportunities After Discounted Cash Flow Training

Discounted cash flow training opens doors to many finance careers.

Financial Analyst

Analysts use DCF to value companies and support investment decisions.

Investment Analyst

Investment professionals use DCF models to evaluate stocks and assets.

Equity Research Analyst

Research analysts rely on DCF valuation to publish reports and recommendations.

Corporate Finance Professional

DCF helps companies plan investments, acquisitions, and budgets.

With DCF skills, you gain strong analytical thinking that employers value.

Common Mistakes in Discounted Cash Flow Analysis

Even trained professionals make mistakes in DCF. Good discounted cash flow training teaches you how to avoid them.

Overly Optimistic Assumptions

Unrealistic growth rates lead to inaccurate valuations.

Ignoring Risk

Using a low discount rate underestimates risk.

Poor Cash Flow Forecasting

Incorrect cash flow estimates reduce reliability.

Blind Trust in One Model

DCF should be combined with other valuation methods.

Learning these mistakes helps you build better DCF models.

Frequently Asked Questions

Is discounted cash flow training difficult?

No. With step-by-step learning and practice, beginners can understand DCF easily.

How long does it take to learn DCF?

Basic DCF concepts can be learned in a few weeks. Mastery takes practice.

Do I need accounting knowledge?

Basic accounting knowledge helps, but many courses teach required concepts from scratch.

Can beginners learn discounted cash flow?

Yes. Beginner-friendly discounted cash flow training explains concepts in simple language.

Is DCF still relevant today?

Yes. Despite market changes, DCF remains one of the most trusted valuation methods.

Final Thoughts on Discounted Cash Flow Training

Discounted cash flow training is one of the most valuable skills you can learn in finance and investing. It helps you understand how businesses create value, how risk affects returns, and how professionals make investment decisions.

Whether you are a student, investor, or working professional, learning DCF improves your financial thinking and decision-making. With the right training, simple explanations, and consistent practice, anyone can master discounted cash flow analysis.

If you want to build strong finance skills and make smarter investment choices, start your discounted cash flow training today and take control of how you value businesses and opportunities.